2022-23 Federal Budget

The pre-election 2022/23 Federal Budget has been touted as pro-growth and a very different beast to 2021/22 when the economic recovery was fragile post rolling lockdowns and limited vaccine coverage. The combination of higher commodity prices and stronger than expected economic growth underpinned a better cash budget position than forecast with the deficit now expected to be $78b down from $99b in the December 2021 estimates. With near full employment, wages growth is finally emerging and, alongside on-going global supply chain issues, rising inflation is putting pressure on consumers and businesses alike. Some of the budget measures are designed to alleviate this pressure with big ticket items including a temporary (6 month) 50% reduction in fuel excise, cash handouts aimed mainly at pensioners and an increase in the Low and Middle Income tax offset (LMITO) from $1,080 to $1,500.

INDIVIDUAL TAXPAYERS

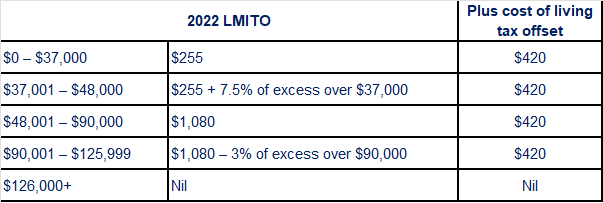

Temporary Increase to Low and Middle Income Tax Offset

To assist with cost of living, the Government has announced a once-off cost of living tax offset applicable only to the 2022 income year and this is delivered by increasing the low and middle income tax offset (LMITO) by $420 for the 2021–2022 income year. This increases the maximum LMITO benefit to $1,500 per individual (up from the current maximum of $1,080).

However, there was no announcement of an extension of the LMITO beyond 30 June 2022.

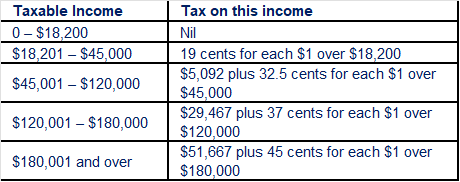

Personal tax rates unchanged for 2022–2023

In the Budget, there were no changes to any personal tax rates. As such, the 2022–2023 tax rates and residents are unchanged from 2021–2022 as follows:

Tax deductibility of COVID-19 test expenses

From 1 July 2021, the costs of taking a COVID-19 test (both polymerase chain reaction (PCR) tests and rapid antigen tests (RATs)) to attend a place of work are tax deductible for individuals. Furthermore, in making these costs tax deductible, the Government will also ensure FBT will not be incurred by businesses where COVID-19 tests are provided to employees for this purpose.

BUSINESS TAXPAYERS

Deduction boosts for small business: skills and training, technology investments

Small and medium-sized businesses (with aggregated annual turnover less than $50 million) will be given a deduction boost of 20% on expenditure incurred on external training courses and adoption of digital technology.

External training courses

As part of the skills and training boost, an additional 20% tax deduction is available on expenditure incurred by eligible businesses on external training courses provided to employees. The external training course must be provided to employees in Australia or online and delivered by entities registered in Australia. Some exclusions will apply, such as for in-house or on-the-job training. This uplift will apply from 7.30pm (AEDT) 29 March 2022 until 30 June 2024. For eligible expenses incurred by 30 June 2022, the boost can only be claimed in the tax returns for the following income year. The boost for eligible expenditure incurred between 1 July 2022 and 30 June 2024 will be claimed in the income year in which the expenditure is incurred.

Technology Investments

Similarly, the additional 20% uplift will be provided to support digital adoption by small and medium-sized businesses. An additional 20% deduction is provided on costs incurred on business expenses and depreciating assets that support digital adoption (such as portable payment devices, cyber security systems or subscriptions to cloud-based services). An annual cap will apply in each qualifying income year so that expenditure up to $100,000 will be eligible for the boost (therefore, the maximum additional deduction per eligible year is $20,000). The boost will apply to eligible expenditure incurred from 7:30 pm (AEDT) on 29 March 2022 until 30 June 2023.

COVID-19 business grants designated NANE income

The Government has extended the measure which enables payments from certain state and territory COVID-19 business support programs to be made non-assessable, non-exempt (NANE) income for income tax purposes until 30 June 2022. The following state and territory grant programs eligible for this treatment since the 2021–2022 Mid-Year Economic and Fiscal Outlook:

New South Wales Accommodation Support Grant

New South Wales Commercial Landlord Hardship Grant

New South Wales Performing Arts Relaunch Package

New South Wales Festival Relaunch Package

New South Wales 2022 Small Business Support Program

Queensland 2021 COVID-19 Business Support Grant

South Australia COVID-19 Tourism and Hospitality Support Grant

South Australia COVID-19 Business Hardship Grant.

SUPERANNUATION

Super guarantee: rate rise unchanged

There were no announcements on any changes to the timing of the next super guarantee (SG) rate increase. It is currently legislated to increase from 10% to 10.5% from 1 July 2022, and by 0.5% per annum from 1 July 2023 until it reaches 12% from 1 July 2025. With the SG rate set to increase to 10.5% for 2022–2023 (up from the current 10%), employers need to be mindful that they cannot use an employee’s salary-sacrificed contributions to reduce the employer’s extra 0.5% obligation of super guarantee.

Super Guarantee opt-out for high-income earners

High-income earners with multiple employers can opt-out of the SG regime in respect of an employer to avoid breaching the concessional contribution caps ($27,500 both for the 2021-2022 as well as the 2022-2023 income years) unintentionally. With the increase in the SG rate to 10.5% from 1 July 2022, the SG opt-out income threshold will decrease from $275,000 to $261,904.

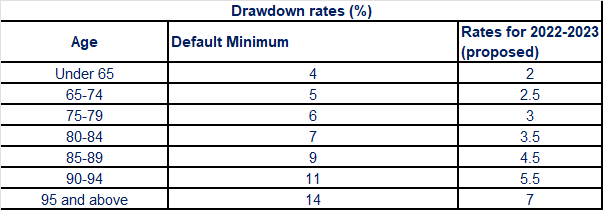

Superannuation pension drawdowns

The temporary 50% reduction in minimum annual payment amounts for superannuation pensions and annuities will be extended to 30 June 2023. The reduction in the minimum payment amounts for 2022–2023 is expected to apply to account-based pensions and similar products.

The effect of the proposed extension of the temporary reduction to the 2022–23 income year is that the minimum pension drawdown rates for account-based pensions will be as follows:

Please don’t hesitate to get in touch with your usual Baumgartners representative to discuss how any of these changes might affect you.

Author

Alex Vrahos

Partner

Alex is a Chartered Accountant (CA) with over 15 years’ experience in senior leadership roles within the mid-tier accounting sector and leading international accounting firms.

Recent articles by Alex

-

Alliott Global APAC Conference 2023

Baumgartners Partner Alex Vrahos reports on another successful Alliott Global conference in the APAC region.

-

Victoria’s Short-Stay Property Tax announced

The Victorian Government introduces Australia's first short-stay property tax, the Short Stay Levy, set at 7.5% of short-stay accommodation platforms' revenue starting from January 2025.

-

Commercial Leasing Code of Conduct for SMEs during COVID-19

The Federal Government has today announced a mandatory code of conduct for lessors and SME lessees with a turnover up to $50 million, to apply for the duration of the Covid-19 crisis.