Commercial Leasing Code of Conduct for SMEs during COVID-19

For many SMEs, rent is often the largest outgoing for their business next to staffing costs. As the impact of the COVID-19 pandemic continues to reverberate across the economic landscape in Australia, the Federal Government, with the backing of the National Cabinet, has today introduced a mandatory code of conduct for application to commercial tenancies for the duration of the COVID-19 pandemic.

The full mandatory code can be found here and we have also extracted relevant sections from the code and reproduced these at the bottom of this article for those who are interested.

We understand that the code is intended to be given the force of law by each state or territory government and will therefore be binding on affected landlords and tenants.

The code seeks to emphasise co-operation and agreement between landlord and tenant and acknowledges that commercial tenancies should be considered on a case-by-case basis. It nevertheless contains some hard thresholds which are clearly intended to deal with those situations where landlord and tenant are unable to reach agreement.

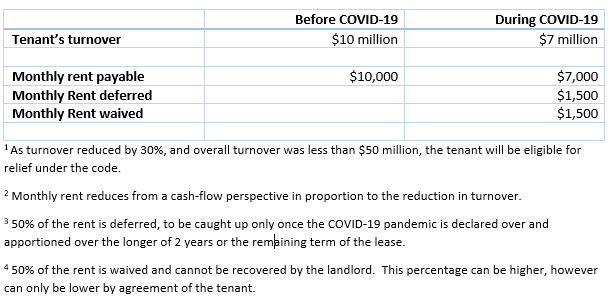

Any business tenant with turnover less than $50 million (known as an “SME tenant”), and which qualifies for the government’s Job Keeper payment, will be automatically covered by the code.

The code operates to share the financial impact of the pandemic between landlord and tenant on a proportional basis. Specifically, a landlord must offer an eligible commercial tenant a proportionate reduction in rent payable, in the form of waivers and deferrals, of up to 100% of the amount ordinarily payable, based on the reduction in the tenant’s trade during the pandemic period and a subsequent reasonable recovery period.

Rental waivers must constitute no less than 50% of the total reduction under this principle, with the balance deferred and recouped over no less than a 2-year period or the remaining term of the lease, whichever is longer. The amount waived cannot be subsequently recouped by the landlord nor can fees or interest be levied.

Landlords must pass on to tenants a proportionate share of any reduction in statutory charges (e.g. land tax or council rates) in accordance with the lease, or any benefit received due to the deferral of loan repayments.

Landlords must also not terminate leases or evict tenants due to non-payment of rent during this period (and a reasonable recovery period thereafter).

There are a number of unanswered questions at this stage, most pressing – how will landlords determine that a tenant qualifies for Job Keeper payments. We presume more announcements will be made on this front by either the Federal or State Government.

The following simple example demonstrates how the mandatory code should apply in practice:

If you need any advice or assistance, please get in touch with us by contacting your regular adviser, calling 03 9851 9000 or emailing info@baumgartners.com.au

Alex Vrahos

Principal

We have extracted what we consider to be the critical parts of the code below.

Key Principles

The key principles, which, it is stated, should be applied on a case-by-case basis as soon as practicable are as follows:

1. Landlords must not terminate leases due to non-payment of rent during the COVID-19 pandemic period (or reasonable subsequent recovery period).

2. Tenants must remain committed to the terms of their lease, subject to any amendments to their rental agreement negotiated under this Code. Material failure to abide by substantive terms of their lease will forfeit any protections provided to the tenant under this Code.

3. Landlords must offer tenants proportionate reductions in rent payable in the form of waivers and deferrals (as outlined under “definitions,” below) of up to 100% of the amount ordinarily payable, on a case-by-case basis, based on the reduction in the tenant’s trade during the COVID-19 pandemic period and a subsequent reasonable recovery period.

4. Rental waivers must constitute no less than 50% of the total reduction in rent payable under principle #3 above over the COVID-19 pandemic period and should constitute a greater proportion of the total reduction in rent payable in cases where failure to do so would compromise the tenant’s capacity to fulfil their ongoing obligations under the lease agreement. Regard must also be had to the Landlord’s financial ability to provide such additional waivers. Tenants may waive the requirement for a 50% minimum waiver by agreement.

5. Payment of rental deferrals by the tenant must be amortised over the balance of the lease term and for a period of no less than 24 months, whichever is the greater, unless otherwise agreed by the parties.

6. Any reduction in statutory charges (e.g. land tax, council rates) or insurance will be passed on to the tenant in the appropriate proportion applicable under the terms of the lease.

7. A landlord should seek to share any benefit it receives due to deferral of loan payments, provided by a financial institution as part of the Australian Bankers Association’s COVID-19 response, or any other case-by-case deferral of loan repayments offered to other Landlords, with the tenant in a proportionate manner.

8. Landlords should where appropriate seek to waive recovery of any other expense (or outgoing payable) by a tenant, under lease terms, during the period the tenant is not able to trade. Landlords reserve the right to reduce services as required in such circumstances.

9. If negotiated arrangements under this Code necessitate repayment, this should occur over an extended period in order to avoid placing an undue financial burden on the tenant. No repayment should commence until the earlier of the COVID-19 pandemic ending (as defined by the Australian Government) or the existing lease expiring and taking into account a reasonable subsequent recovery period.

10. No fees, interest or other charges should be applied with respect to rent waived in principles #3 and #4 above and no fees, charges nor punitive interest may be charged on deferrals in principles #3, #4 and #5 above.

11. Landlords must not draw on a tenant’s security for the non-payment of rent (be this a cash bond, bank guarantee or personal guarantee) during the period of the COVID-19 pandemic and/or a reasonable subsequent recovery period.

12. The tenant should be provided with an opportunity to extend its lease for an equivalent period of the rent waiver and/or deferral period outlined in item #2 above. This is intended to provide the tenant additional time to trade, on existing lease terms, during the recovery period after the COVID-19 pandemic concludes.

13. Landlords agree to a freeze on rent increases (except for retail leases based on turnover rent) for the duration of the COVID-19 pandemic and a reasonable subsequent recovery period, notwithstanding any arrangements between the landlord and the tenant.

14. Landlords may not apply any prohibition on levy any penalties if tenants reduce opening hours or cease to trade due to the COVID-19 pandemic.

Binding Mediation

Where landlords and tenants cannot reach agreement on leasing arrangements (as a direct result of the COVID-19 pandemic), the matter should be referred and subjected (by either party) to applicable state or territory retail/commercial leasing dispute resolution processes for binding mediation, including Small Business Commissioners/Champions/Ombudsmen where applicable.

Landlords and tenants must not use mediation processes to prolong or frustrate the facilitation of amicable resolution outcomes.

Definitions

The following definitions are provided for reference in the application of this Code.

1. Financial Stress or Hardship: an individual, business or company's inability to generate sufficient revenue as a direct result of the COVID-19 pandemic (including government-mandated trading restrictions) that causes the tenant to be unable to meet its financial and/or contractual (including retail leasing) commitments. SME tenants which are eligible for the federal government’s JobKeeper payment are automatically considered to be in financial distress under this Code.

2. Sufficient and accurate information: this includes information generated from an accounting system, and information provided to and/or received from a financial institution, that impacts the timeliness of the Parties making decisions with regard to the financial stress caused as a direct result of the COVID-19 event.

3. Waiver and deferral: any reference to waiver and deferral may also be interpreted to include other forms of agreed variations to existing leases (such as deferral, pausing and/or hibernating the lease), or any other such commercial outcome of agreements reached between the parties. Any amount of reduction provided by a waiver may not be recouped by the Landlord over the term of the lease.

4. Proportionate: the amount of rent relief proportionate to the reduction in trade as a result of the COVID-19 pandemic plus a subsequent reasonable recovery period, consistent with assessments undertaken for eligibility for the Commonwealth’s JobKeeper programme.

Author

Alex Vrahos

Partner

Alex is a Chartered Accountant (CA) with over 15 years’ experience in senior leadership roles within the mid-tier accounting sector and leading international accounting firms.

Recent articles by Alex

-

Commercial Leasing Code of Conduct for SMEs during COVID-19

The Federal Government has today announced a mandatory code of conduct for lessors and SME lessees with a turnover up to $50 million, to apply for the duration of the Covid-19 crisis.

-

Baumgartners Attends Alliott Global Alliance® 2025 ANZAC Conference

Baumgartners recently participated in the Alliott Global Alliance® 2025 ANZAC Conference, held in Sydney.

-

2022-23 Federal Budget

This Federal Budget has placed focus on securing Australia’s economic recovery. We’ve outlined the key elements that may affect you.